Most Kenyans at one time or another must have received a message pop up on their phone uninvited offering up to 100,000Ksh of an unsecured mobile loan.

The promise is always something like this… Follow our easy steps by downloading our loan app and borrow, for a start 1,000 Kenyan shillings while building your account for more borrowing in the near future.

This is even more so for the Kenyans who have never taken an instant mobile loan in Kenya before, since it’s believed their credit file is still clean.

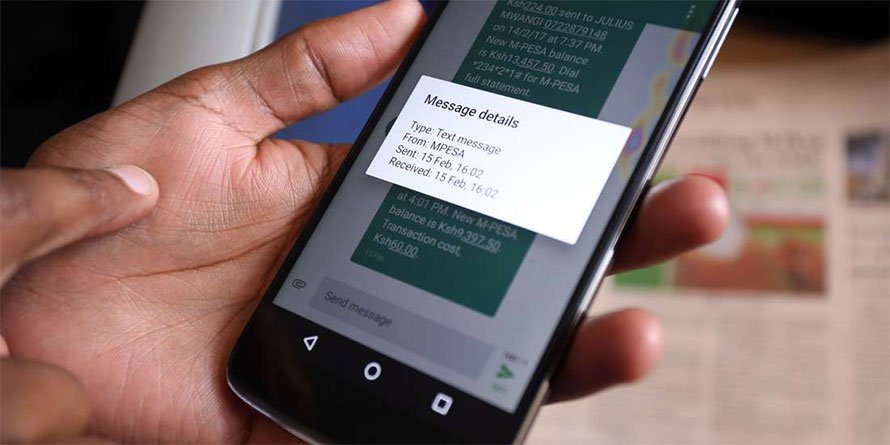

Wow, how did we get here? I remember the days one would wondered who’s behind you had to kiss at Barclays to even get a loan form. Today banks and mobile loan apps are paying top dollar for your phone number to try entice you to an unsecured instant mobile loans in Kenya irrespective of your credit history. This must be the easiest cash anyone is willing to give, no trip to the bank, no long stories about your dream business, no bank ques, just your “mulika mwizi”.

Hundreds if not thousands of Kenyans today get bombarded on social media by mobile loan apps developers as they intensify their hunt for customers through Facebook, Twitter and Instagram.

Mobile loan apps developers both in Kenya and internationally targeting Kenya are mainly advertising on social media by targeting especially the young Kenyans. The Kenyan millennials are busy searching online for loans and mobile loan apps to borrow unsecured loans fast.

These mobile loan apps in Kenya would normally offer instant mobile loans in Kenya to your Mpesa account, by requesting you to download their loan app right away and borrow as low as 100 shillings and up to 50,000 shillings without any guarantors, security or office visits. To a certain extent it sounds unreal.

Ordinarily one would have to visit the banking hall in Kenya to apply for a loan, which would take months to process with a file of security documents that have to be validated by the bank. Tables have turned, now the mobile lender is one desperately chasing after you with enticing loan offers. It’s clearly the digital age.

Kenya today has more than 50 mobile loans apps that offer borrowers instant mobile loans in Kenya depending on their Mpesa usage records. Most mobile loans apps are standalone products but commercial banks have recently joined the mobile loan explosion in Kenya.

Instant mobile loans in Kenya on average offer loans at an interest rate of up to 15 per cent per month, way over the 13 percent per annum that formal banks offer as controlled by the Central Bank of Kenya.

35 per cent of mobile phone users have at some point accessed the instant mobile loans in Kenya, which is about 6 million people having taken a mobile loan through the mobile loan apps targeting the Kenyan market.

Most of these 6 million people are the youth, who are also active users of social media sites. Due to the high demand for loans from the young Kenyans, banks are also rushing to launch similar mobile loan services using their new loan apps developed for these purpose.

Instant mobile loans in Kenya though, disposes the Kenyan economy to risks that include money laundering, terrorist financing and technology risks as noted by the Central Bank, Capital Markets Authority, Insurance Regulatory Authority, Sacco Regulatory Authority and Retirement Benefits Authority, in a report released in October 2018.

Some Kenyans are known to have taken up to 10 instant mobile loans in Kenya from 10 different lenders through their mobile loan apps.

Before taking a loan it is wise to read our 5 Questions to ask yourself before you take a Loan.

Check out these Top 10 Loan Apps in Kenya, KCB Mpesa Loan, Saida Loan, MShwari, Timiza Loan, Branch Loan, Okash loan, Tala Loan.